- Posted By: namita

- Comments: 0

Posted By namita on June 30, 2017

Credit Card Approval System Data flow diagram is often used as a preliminary step to create an overview of the Credit Card without going into great detail, which can later be elaborated.it normally consists of overall application dataflow and processes of the Credit Card process. It contains all of the userflow and their entities such all the flow of Credit Card, Application, Consumer, Limits, Cibil Reports, Document, Login. All of the below diagrams has been used for the visualization of data processing and structured design of the Credit Card process and working flow.

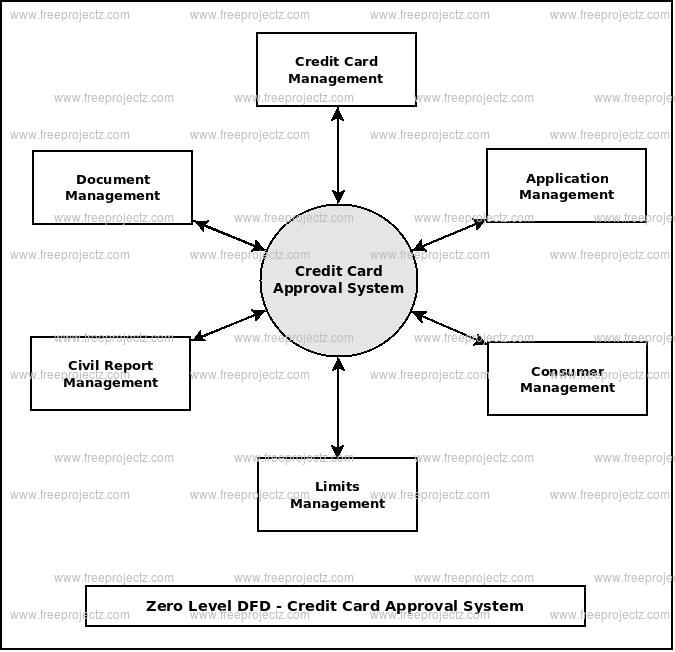

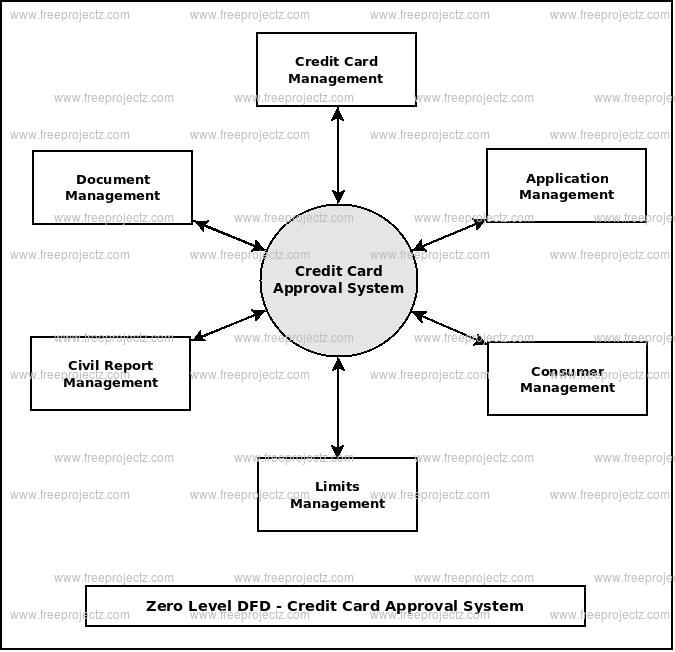

Zero Level Data flow Diagram(0 Level DFD) of Credit Card Approval System :

This is the Zero Level DFD of Credit Card Approval System, where we have eloborated the high level process of Credit Card. It’s a basic overview of the whole Credit Card Approval System or process being analyzed or modeled. It’s designed to be an at-a-glance view of Cibil Reports,Document and Login showing the system as a single high-level process, with its relationship to external entities of Credit Card,Application and Consumer. It should be easily understood by a wide audience, including Credit Card,Consumer and Cibil Reports In zero leve DFD of Credit Card Approval System, we have described the high level flow of the Credit Card system.High Level Entities and proccess flow of Credit Card Approval System:

- Managing all the Credit Card

- Managing all the Application

- Managing all the Consumer

- Managing all the Limits

- Managing all the Cibil Reports

- Managing all the Document

- Managing all the Login

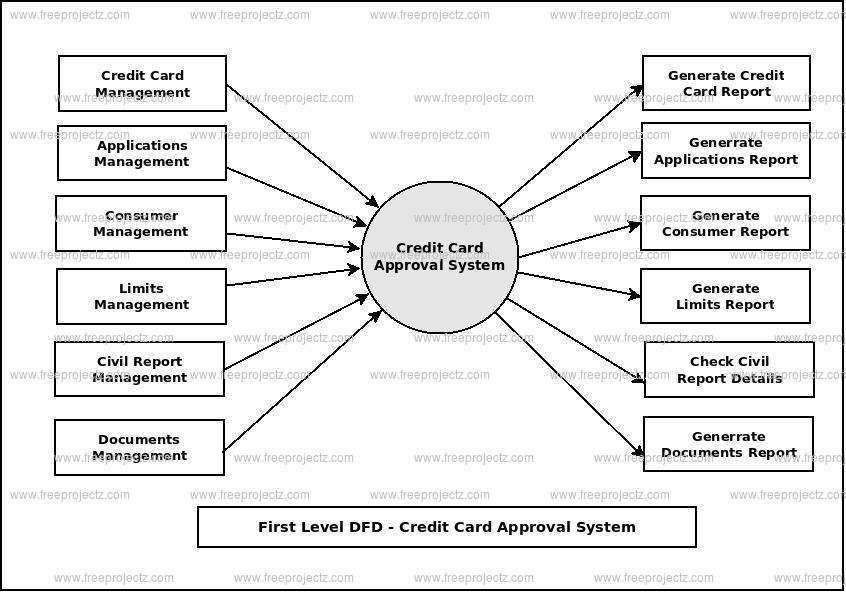

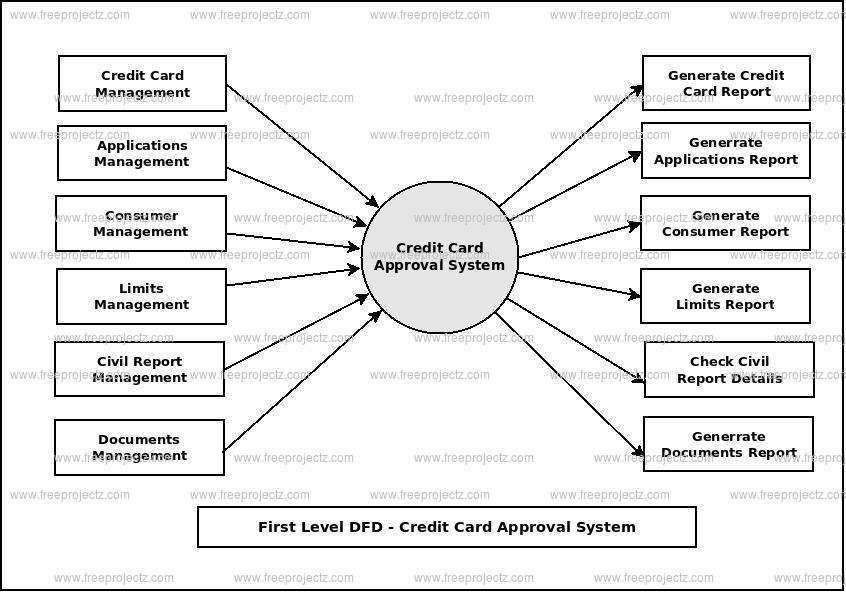

First Level Data flow Diagram(1st Level DFD) of Credit Card Approval System :

First Level DFD (1st Level) of Credit Card Approval System shows how the system is divided into sub-systems (processes), each of which deals with one or more of the data flows to or from an external agent, and which together provide all of the functionality of the Credit Card Approval System system as a whole. It also identifies internal data stores of Login, Document, Cibil Reports, Limits, Consumer that must be present in order for the Credit Card system to do its job, and shows the flow of data between the various parts of Credit Card, Consumer, Document, Login, Cibil Reports of the system. DFD Level 1 provides a more detailed breakout of pieces of the 1st level DFD. You will highlight the main functionalities of Credit Card.Main entities and output of First Level DFD (1st Level DFD):

- Processing Credit Card records and generate report of all Credit Card

- Processing Application records and generate report of all Application

- Processing Consumer records and generate report of all Consumer

- Processing Limits records and generate report of all Limits

- Processing Cibil Reports records and generate report of all Cibil Reports

- Processing Document records and generate report of all Document

- Processing Login records and generate report of all Login

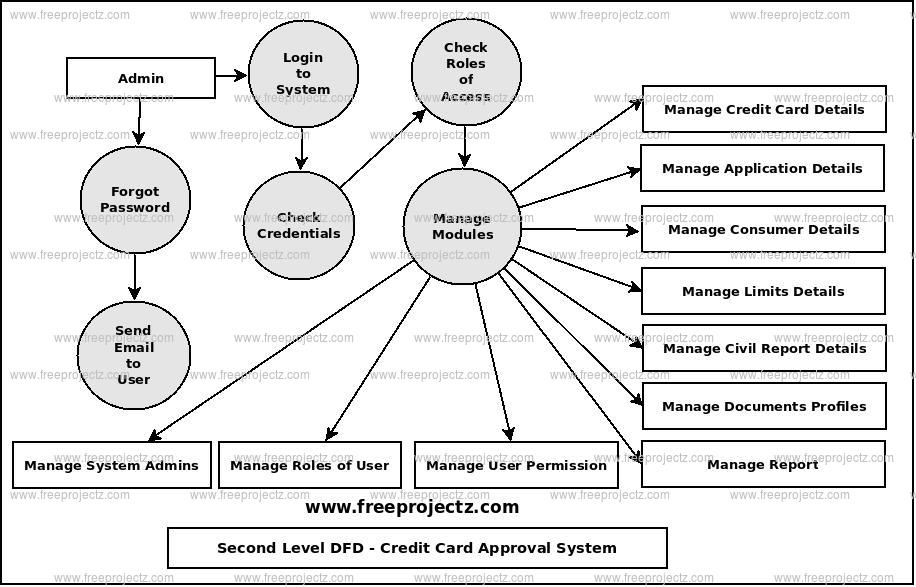

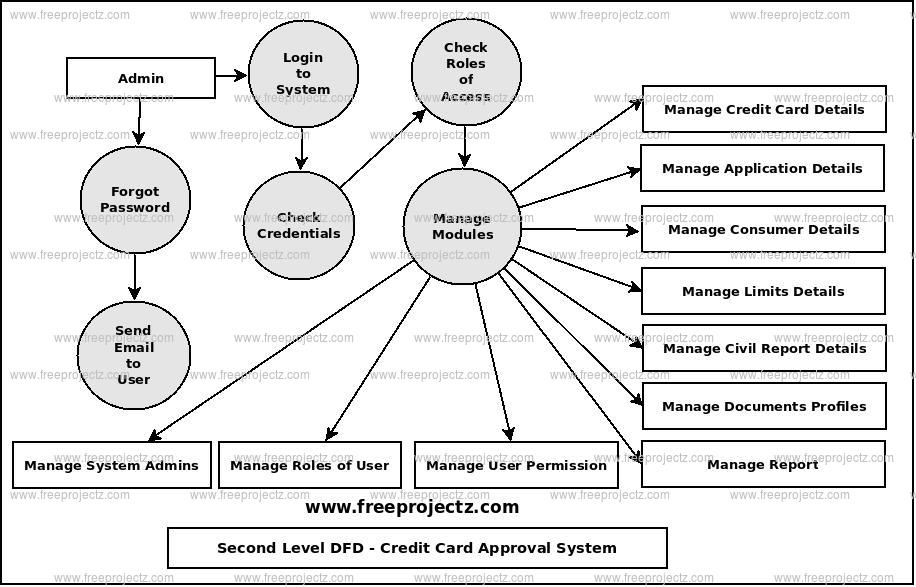

Second Level Data flow Diagram(2nd Level DFD) of Credit Card Approval System :

DFD Level 2 then goes one step deeper into parts of Level 1 of Credit Card. It may require more functionalities of Credit Card to reach the necessary level of detail about the Credit Card functioning. First Level DFD (1st Level) of Credit Card Approval System shows how the system is divided into sub-systems (processes). The 2nd Level DFD contains more details of Login, Document, Cibil Reports, Limits, Consumer, Application, Credit Card.Low level functionalities of Credit Card Approval System

- Admin logins to the system and manage all the functionalities of Credit Card Approval System

- Admin can add, edit, delete and view the records of Credit Card, Consumer, Cibil Reports, Login

- Admin can manage all the details of Application, Limits, Document

- Admin can also generate reports of Credit Card, Application, Consumer, Limits, Cibil Reports, Document

- Admin can search the details of Application, Cibil Reports, Document

- Admin can apply different level of filters on report of Credit Card, Limits, Cibil Reports

- Admin can tracks the detailed information of Application, Consumer, Limits, , Cibil Reports