- Posted By: freeproject

- Comments: 0

- Posted By: freeproject

- Comments: 0

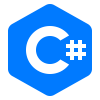

internet Banking System Activity Diagram

This is the Activity UML diagram of internet Banking System which shows the flows between the activity of Services, Fund Transfer, Debit, Payee, Credit. The main activity involved in this UML Activity Diagram of internet Banking System are as follows:

- Services Activity

- Fund Transfer Activity

- Debit Activity

- Payee Activity

- Credit Activity

Features of the Activity UML diagram of internet Banking System

- Admin User can search Services, view description of a selected Services, add Services, update Services and delete Services.

- Its shows the activity flow of editing, adding and updating of Fund Transfer

- User will be able to search and generate report of Debit, Payee, Credit

- All objects such as ( Services, Fund Transfer, Credit) are interlinked

- Its shows the full description and flow of Services, Payee, Credit, Debit, Fund Transfer

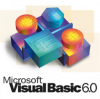

Login Activity Diagram of internet Banking System:

This is the Login Activity Diagram of internet Banking System, which shows the flows of Login Activity, where admin will be able to login using their username and password. After login user can manage all the operations on Debit, Services, Fund Transfer, Credit, Payee. All the pages such as Fund Transfer, Credit, Payee are secure and user can access these page after login. The diagram below helps demonstrate how the login page works in a internet Banking System. The various objects in the Credit, Debit, Services, Fund Transfer, and Payee page—interact over the course of the Activity, and user will not be able to access this page without verifying their identity.

- Posted By: freeproject

- Comments: 0

Internet Banking Class Diagram

internet Banking Class Diagram describes the structure of a internet Banking classes, their attributes, operations (or methods), and the relationships among objects. The main classes of the internet Banking are Banks, Credit, Debits, Fund Transfers, Services, User.

Classes of internet Banking Class Diagram:

- Banks Class : Manage all the operations of Banks

- Credit Class : Manage all the operations of Credit

- Debits Class : Manage all the operations of Debits

- Fund Transfers Class : Manage all the operations of Fund Transfers

- Services Class : Manage all the operations of Services

- User Class : Manage all the operations of User

Classes and their attributes of internet Banking Class Diagram:

- Banks Attributes : bank_id, bank_customer_id, bank_name, bank_branch_code, bank_place, bank_type, bank_description

- Credit Attributes : credit_id, credit_name, credit_amount, credit_total, credit_type, credit_description

- Debits Attributes : debit_id, debit_name, debit_amount, debit_total, debit_type, debit_description

- Fund Transfers Attributes : transfer_id, transfer_bank_id, transfer_name, transfer_fund, transfer_total, transfer_type, transfer_description

- Services Attributes : service_id, service_bank_id, service_name, service_type, service_description

- User Attributes : user_id, user_name, user_mobile, user_email, user_username, user_password, user_address

Classes and their methods of internet Banking Class Diagram:

- Banks Methods : addBanks(), editBanks(), deleteBanks(), updateBanks(), saveBanks(), searchBanks()

- Credit Methods : addCredit(), editCredit(), deleteCredit(), updateCredit(), saveCredit(), searchCredit()

- Debits Methods : addDebits(), editDebits(), deleteDebits(), updateDebits(), saveDebits(), searchDebits()

- Fund Transfers Methods : addFund Transfers(), editFund Transfers(), deleteFund Transfers(), updateFund Transfers(), saveFund Transfers(), searchFund Transfers()

- Services Methods : addServices(), editServices(), deleteServices(), updateServices(), saveServices(), searchServices()

- User Methods : addUser(), editUser(), deleteUser(), updateUser(), saveUser(), searchUser()

Class Diagram of internet Banking :

- Posted By: freeproject

- Comments: 0

internet Banking System Component Diagram

This is a Component diagram of internet Banking System which shows components, provided and required interfaces, ports, and relationships between the Payee, Bank, Services, Debit and Fund Transfer. This type of diagrams is used in Component-Based Development (CBD) to describe systems with Service-Oriented Architecture (SOA). internet Banking System UML component diagram, describes the organization and wiring of the physical components in a system.

Components of UML Component Diagram of internet Banking System:

- Payee Component

- Bank Component

- Services Component

- Debit Component

- Fund Transfer Component

Featues of internet Banking System Component Diagram:

- You can show the models the components of internet Banking System.

- Model the database schema of internet Banking System

- Model the executables of an application of internet Banking System

- Model the system's source code of internet Banking System

- Posted By: freeproject

- Comments: 0

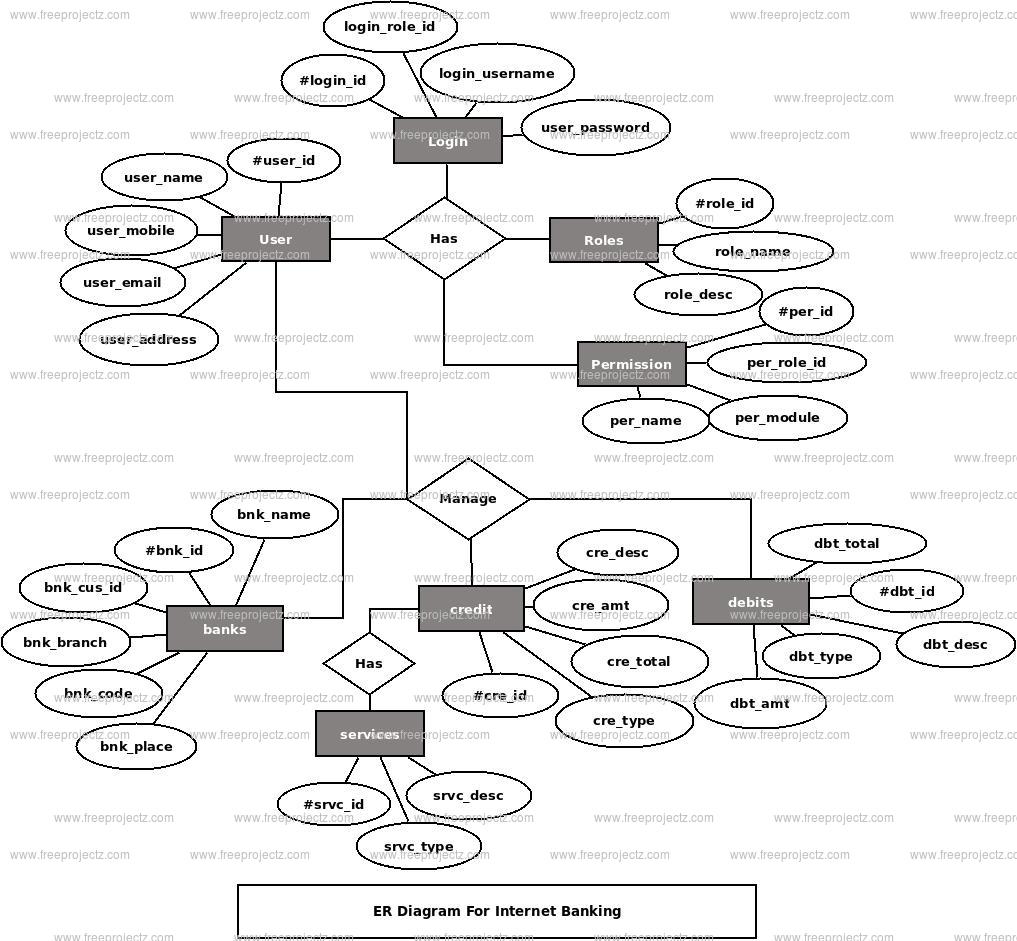

internet Banking ER Diagram

This ER (Entity Relationship) Diagram represents the model of internet Banking Entity. The entity-relationship diagram of internet Banking shows all the visual instrument of database tables and the relations between Credit, Fund Transfers, Banks, User etc. It used structure data and to define the relationships between structured data groups of internet Banking functionalities. The main entities of the internet Banking are Banks, Credit, Debits, Fund Transfers, Services and User.

internet Banking entities and their attributes :

- Banks Entity : Attributes of Banks are bank_id, bank_customer_id, bank_name, bank_branch_code, bank_place, bank_type, bank_description

- Credit Entity : Attributes of Credit are credit_id, credit_name, credit_amount, credit_total, credit_type, credit_description

- Debits Entity : Attributes of Debits are debit_id, debit_name, debit_amount, debit_total, debit_type, debit_description

- Fund Transfers Entity : Attributes of Fund Transfers are transfer_id, transfer_bank_id, transfer_name, transfer_fund, transfer_total, transfer_type, transfer_description

- Services Entity : Attributes of Services are service_id, service_bank_id, service_name, service_type, service_description

- User Entity : Attributes of User are user_id, user_name, user_mobile, user_email, user_username, user_password, user_address

Description of internet Banking Database :

- The details of Banks is store into the Banks tables respective with all tables

- Each entity (User, Debits, Services, Credit, Banks) contains primary key and unique keys.

- The entity Debits, Services has binded with Banks, Credit entities with foreign key

- There is one-to-one and one-to-many relationships available between Services, Fund Transfers, User, Banks

- All the entities Banks, Services, Debits, User are normalized and reduce duplicacy of records

- We have implemented indexing on each tables of internet Banking tables for fast query execution.

- Posted By: freeproject

- Comments: 0

internet Banking System Sequence Diagram

This is the UML sequence diagram of internet Banking System which shows the interaction between the objects of Fund Transfer, Credit, Debit, Bank, Payee. The instance of class objects involved in this UML Sequence Diagram of internet Banking System are as follows:

- Fund Transfer Object

- Credit Object

- Debit Object

- Bank Object

- Payee Object

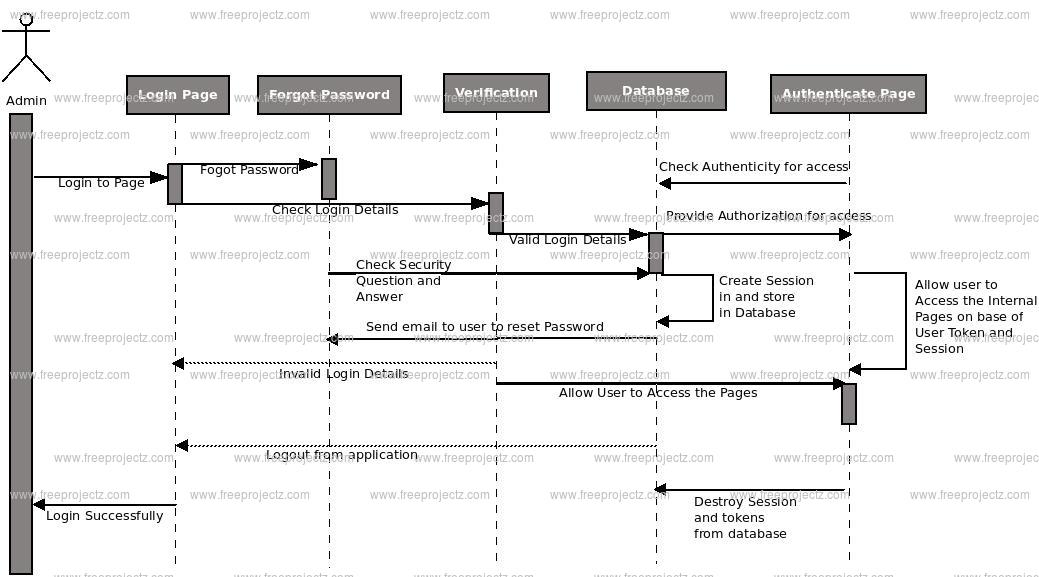

Login Sequence Diagram of internet Banking System:

This is the Login Sequence Diagram of internet Banking System, where admin will be able to login in their account using their credentials. After login user can manage all the operations on Debit, Fund Transfer, Credit, Payee, Bank. All the pages such as Credit, Payee, Bank are secure and user can access these page after login. The diagram below helps demonstrate how the login page works in a internet Banking System. The various objects in the Payee, Debit, Fund Transfer, Credit, and Bank page—interact over the course of the sequence, and user will not be able to access this page without verifying their identity.

This is the UML sequence diagram of internet Banking System which shows the interaction between the objects of Fund Transfer, Credit, Debit, Bank, Payee. The instance of class objects involved in this UML Sequence Diagram of internet Banking System are as follows:

- Fund Transfer Object

- Credit Object

- Debit Object

- Bank Object

- Payee Object

- Posted By: freeproject

- Comments: 0

Internet Banking Use Case Diagram

This Use Case Diagram is a graphic depiction of the interactions among the elements of Internet Banking. It represents the methodology used in system analysis to identify, clarify, and organize system requirements of Internet Banking. The main actors of Internet Banking in this Use Case Diagram are: Super Admin, System User, Cashiers, Customers, who perform the different type of use cases such as Manage Banks, Manage Credit, Manage Debits, Manage Fund Transfers, Manage Payee, Manage Services, Manage Users and Full Internet Banking Operations. Major elements of the UML use case diagram of Internet Banking are shown on the picture below.

The relationships between and among the actors and the use cases of Internet Banking:

- Super Admin Entity : Use cases of Super Admin are Manage Banks, Manage Credit, Manage Debits, Manage Fund Transfers, Manage Payee, Manage Services, Manage Users and Full Internet Banking Operations

- System User Entity : Use cases of System User are Manage Banks, Manage Credit, Manage Debits, Manage Fund Transfers, Manage Payee, Manage Services

- Cashiers Entity : Use cases of Cashiers are Check Deposit Request, Make Deposit, Search Customers, Check Statements

- Customers Entity : Use cases of Customers are Manage Beneficiary, Trasfer Funds, Check Balance, Print Statements

Use Case Diagram of Internet Banking :